IN State Form 9284 2002 free printable template

Show details

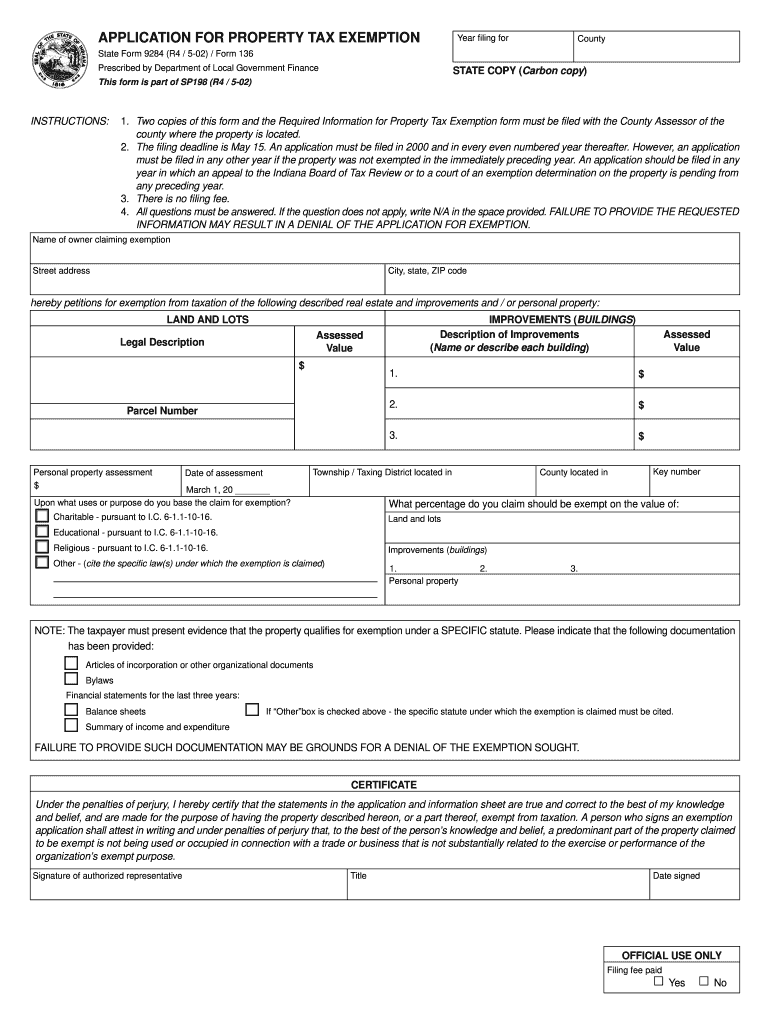

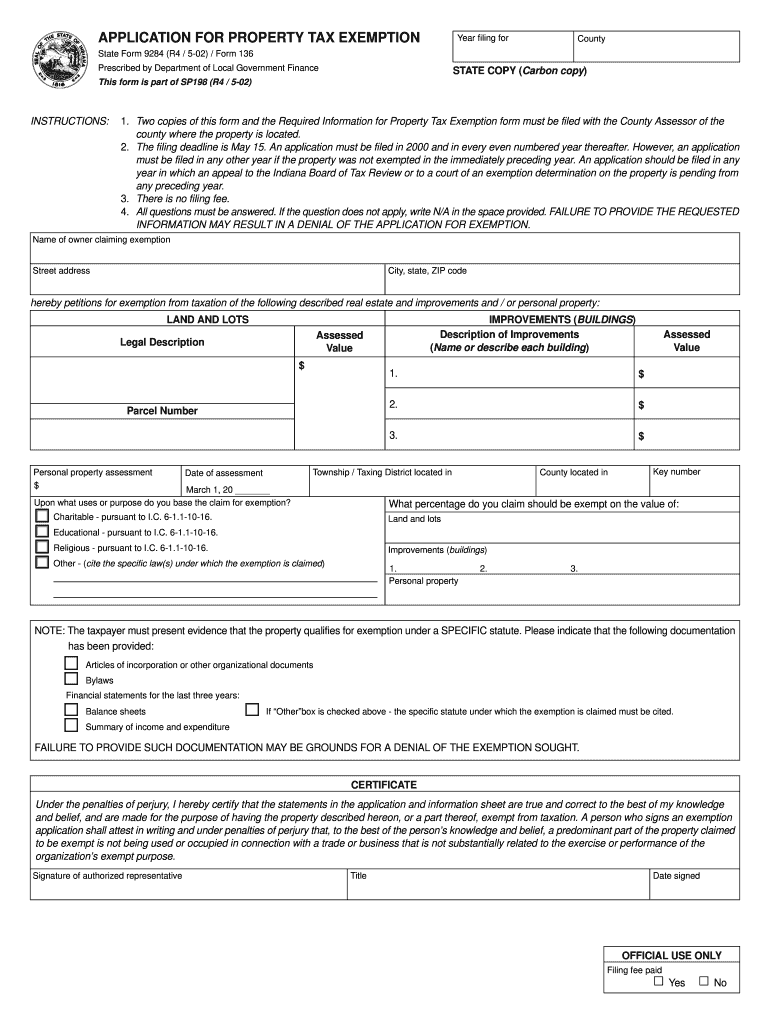

APPLICATION FOR PROPERTY TAX EXEMPTION Year filing for County State Form 9284 (R4 / 5-02) / Form 136 Prescribed by Department of Local Government Finance STATE COPY (Carbon copy) This form is part

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN State Form 9284

Edit your IN State Form 9284 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN State Form 9284 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IN State Form 9284 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IN State Form 9284. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN State Form 9284 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IN State Form 9284

How to fill out IN State Form 9284

01

Obtain IN State Form 9284 from the official website or local office.

02

Read the instructions carefully before filling the form.

03

Enter your personal information in the designated sections, including your name, address, and contact details.

04

Provide any required identification numbers, such as Social Security or driver's license numbers.

05

Complete the specific sections related to the purpose of the form, ensuring all necessary details are filled in.

06

Review the form for accuracy and completeness before submitting.

07

Sign and date the form where required.

08

Submit the form to the appropriate state department or agency as indicated in the instructions.

Who needs IN State Form 9284?

01

Individuals applying for services or benefits that require this specific form.

02

Residents of Indiana who need to report certain information to state authorities.

03

Anyone required to complete this form for compliance with state regulations.

Fill

form

: Try Risk Free

People Also Ask about

How do I get property tax exemption in California?

To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor.

At what age do you stop paying property tax in California?

Reappraisal Exclusion for Seniors - Occurring On or After April 1, 2021. This is a property tax savings program for those aged 55 or older who are selling their home and buying another home. Under Proposition 13, a home is normally appraised at its full market value at the time it is purchased.

What is the current homestead exemption in California?

Declared Homestead. Currently, the California homestead exemption is automatic, meaning that a homestead declaration does not need to be filed with the county clerk. Under the new 2021 law, $300,000–$600,000 of a home's equity cannot be touched by judgment creditors.

What are the two types of homestead exemptions in California?

There are two types of homesteads, automatic and declared.

How do I get over 65 property tax exemption in California?

The State Controller's Property Tax Postponement Program allows homeowners who are seniors, are blind, or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria, including at least 40 percent equity in the home and an annual household income of $51,762 or less

Does California have homestead exemption for seniors?

If you are age 55 or older, you may have a significant equity in your home. California provides a special homestead exemption for seniors age 65 and over, people who are disabled, and people age 55 and over with low incomes. (A homestead is your primary residence.)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IN State Form 9284 directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your IN State Form 9284 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I make changes in IN State Form 9284?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your IN State Form 9284 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my IN State Form 9284 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your IN State Form 9284 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is IN State Form 9284?

IN State Form 9284 is a tax form used by certain individuals or entities in Indiana to report income and calculate state tax liabilities.

Who is required to file IN State Form 9284?

Individuals or entities that have certain types of income taxable in Indiana are required to file IN State Form 9284, which may include businesses, non-residents, or those with specific tax obligations.

How to fill out IN State Form 9284?

To fill out IN State Form 9284, you must provide personal and financial information, report income, deductions, and calculate the tax owed. It is essential to follow the instructions provided with the form carefully.

What is the purpose of IN State Form 9284?

The purpose of IN State Form 9284 is to facilitate the reporting of income and tax obligations for Indiana residents and businesses, ensuring compliance with state tax laws.

What information must be reported on IN State Form 9284?

Information that must be reported on IN State Form 9284 includes the taxpayer's identification details, income details, deductions, credits, and the final tax calculation.

Fill out your IN State Form 9284 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN State Form 9284 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.